Can I Discharge My Tax Liability?

/Benjamin Frank once uttered the famous words "In this world nothing can be said to be certain, except death and taxes." Although mostly true, in the land of Bankruptcy, the great forefather is not entirely correct.

You see, under normal circumstances, a person can only discharge normal unsecured debt like credit cards, repossessed car debt, and any personal debts that do not have collateral attached to them. That means, usually, that Taxes and Student loans survive bankruptcy.

This can be a potentially disastrous consequence, however, considering some people may have tax liability from a past business or for other reasons. Seeing this potential outcome, Congress carved out a provision where one can actually discharge taxes, but only if they meet a certain number of requirements:

- The Tax Debt can only be for income. That means that the tax cannot be for payroll or some sort of penalty as a result of a fraudulent filing.

- You did not commit fraud or willful evasion. This is fairly self-explanatory. If you try to cheat the tax man, you can't discharge any debt that results from it.

- The debt is at least three years old. This means that the tax debt accrued from a year that was over three years ago. That is, if its 2015, you can only discharge debt from 2012 and before (provided you meet the remaining requirements).

- You filed a tax return at least two years prior to filing. If you haven't filed the return, you cannot discharge it.

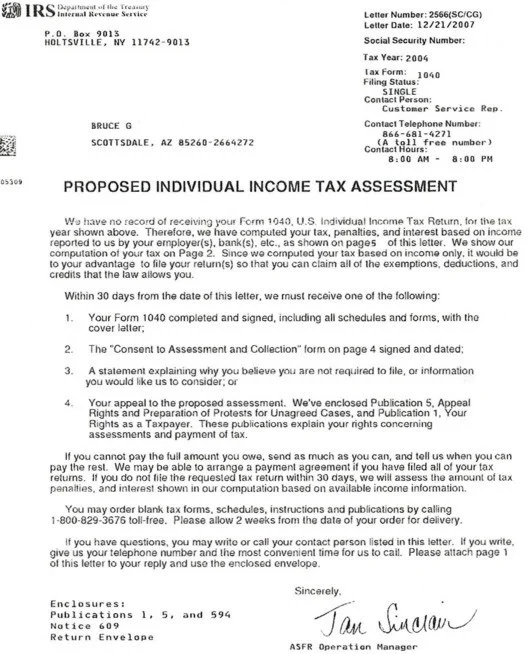

- The income tax debt must have been assessed by the IRS at least 240 days prior to your filing (or not at all). This is the scary looking document that is provided below. These are essentially collection letters by the IRS or other taxing authority.

If you meet these requirements, you may have dischargeable tax debt. You should, however, always consult with a bankruptcy professional to confirm.

In the end, Ben Frank was right, Taxes are certain. Whether or not you will need to pay the taxes may not be so certain. Contact our office to discuss.

Tax Assessment: